Backdoor Ira Limit 2025 - Backdoor Ira Limit 2025 Farah Maureene, In 2025, the contribution limits rise to $7,000, or $8,000 for. Backdoor Ira Limit 2025. Here's how those contribution limits stack up for the 2023 and 2025 tax years. (subject to the annual deferred contribution plan limit of $69,000 for 2025, or $76,500.

Backdoor Ira Limit 2025 Farah Maureene, In 2025, the contribution limits rise to $7,000, or $8,000 for.

Roth Ira Conversion Rules 2025 Aubine Carroll, The ira contribution limits for a particular year govern the amount that can be contributed to a traditional ira to start the backdoor roth.

Backdoor Roth Ira Contribution Limits 2025 Catch Up Haley Keriann, How much can you convert to a backdoor roth?

Backdoor Roth Ira Limits 2025 Darb Doroteya, Over the past four years, we've maximized.

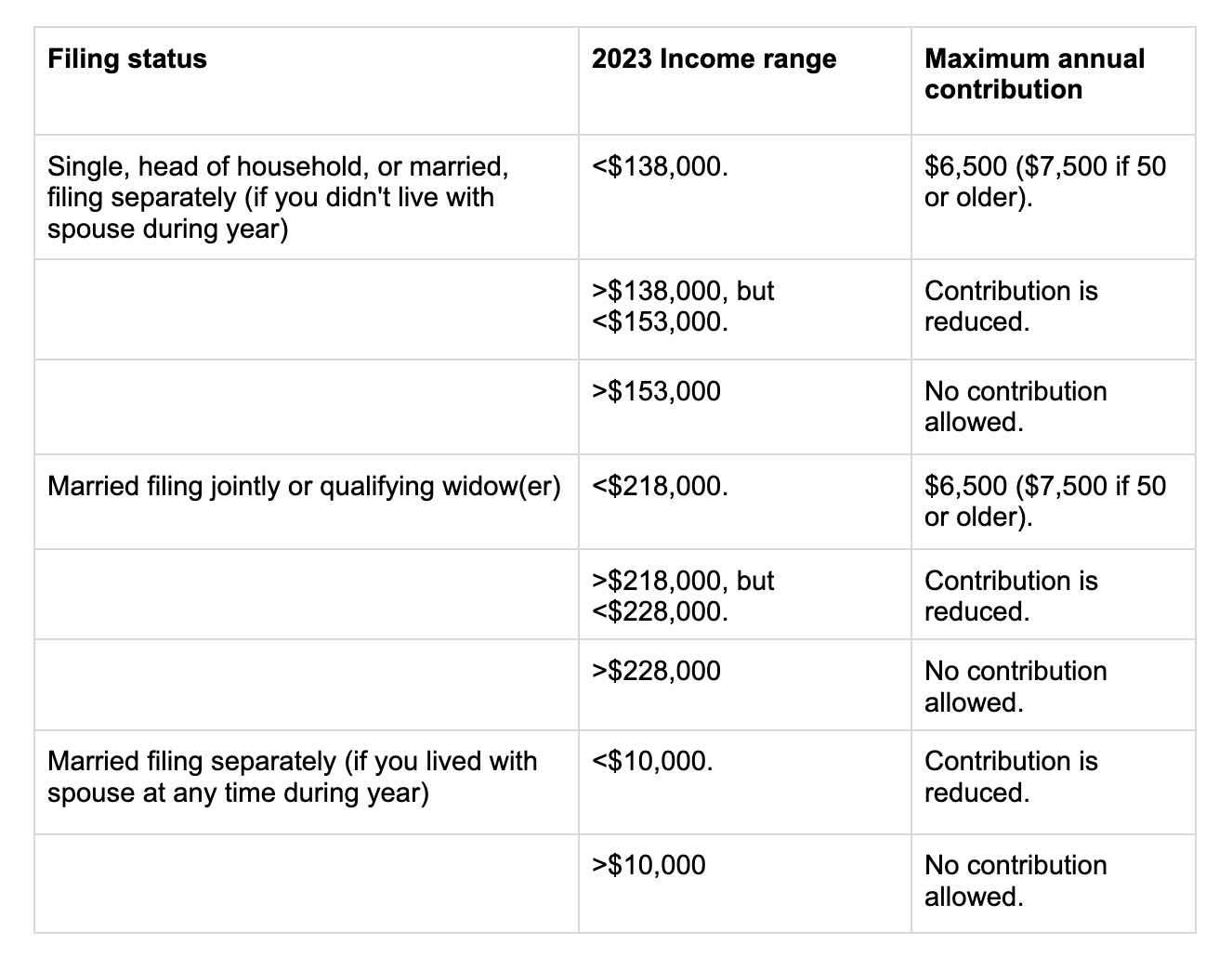

Mega Backdoor Roth Limit 2025 Cris Michal, For single filers, the limit was between $138,000 and.

Backdoor Roth Ira Contribution Limits 2025 Lizzy Margarete, Depending on how you invest that money, you could see greater long.

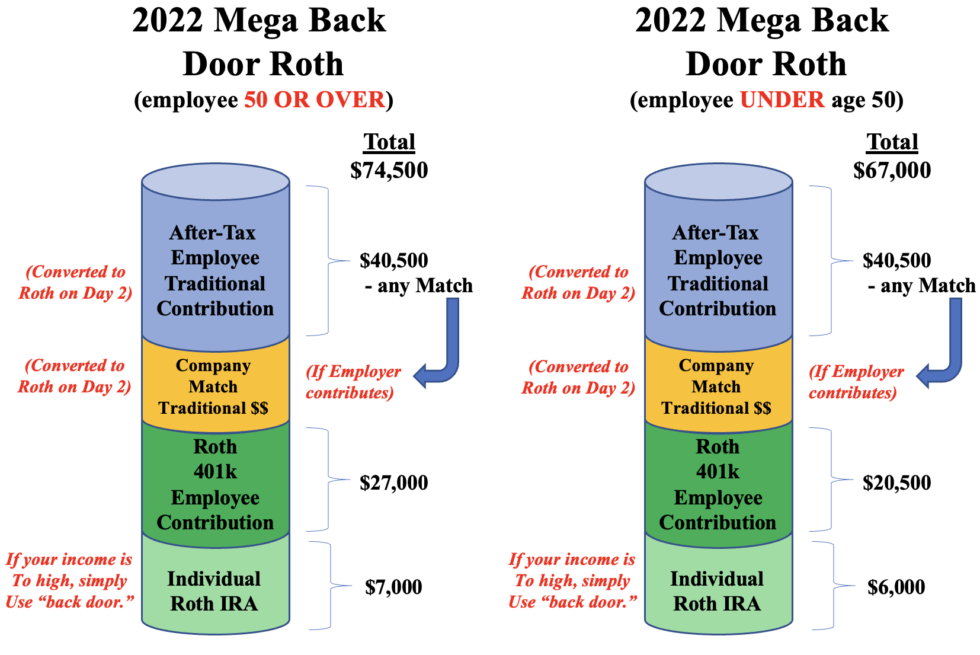

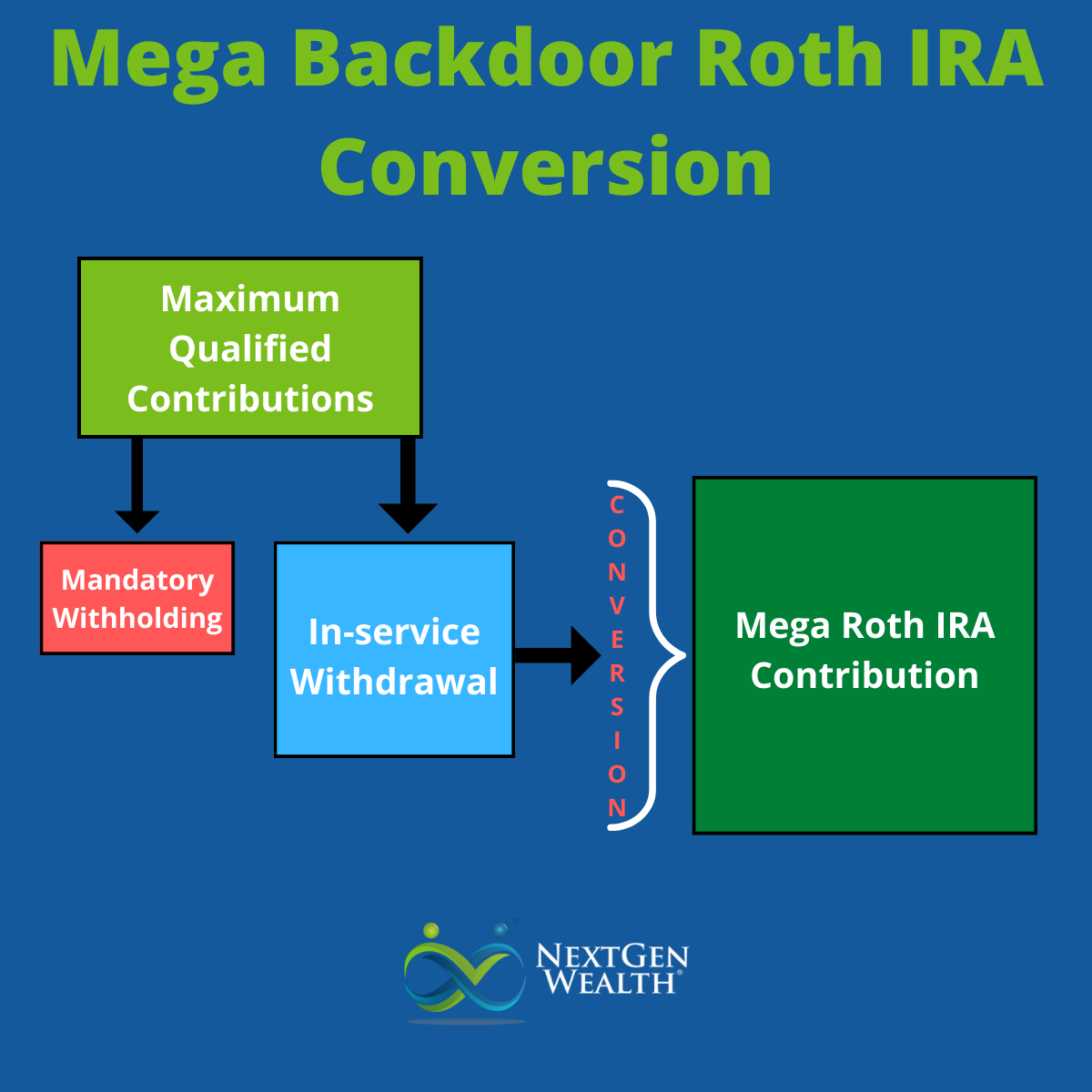

Backdoor Roth Limits 2025 Flora Jewelle, A mega backdoor roth refers to a strategy that can potentially allow some people who would be ineligible to contribute to a roth account, based on their income or.

Backdoor Roth Contribution Limits 2025 Lois Sianna, The maximum ira contribution limit for 2025 is $7,000 for most account holders and $8,000 for those aged.

Backdoor Roth Contribution Limits 2025 Lois Sianna, If your modified adjusted gross income (magi)*** for the calendar year ending december 31st 2025 is going to be above the 2025 irs upper income limits.

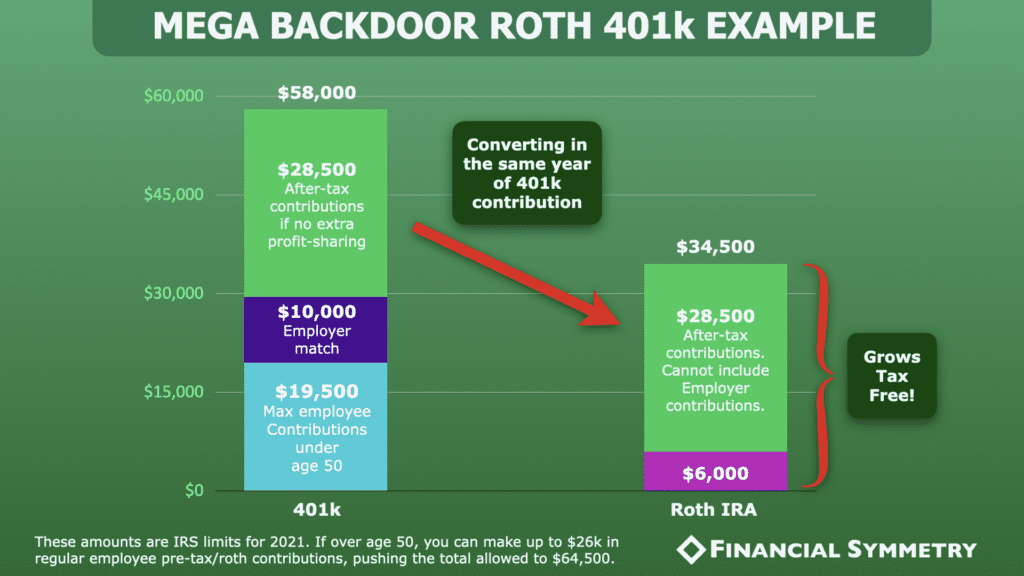

In 2025, the contribution limit is $23,000 if you’re under 50 and $30,500 if you’re over 50. In 2023, the income limit for a backdoor roth ira was between $218,000 and $228,000 for joint filers.